With the Fed and other major central banks around the world, it seems that the earliest interest rate reduction will begin in June, and bond traders are cautiously re -betting on a few weeks ago that they will lose heavy losses.

Earlier, the bets on the major central banks will quickly relax the monetary policy in 2024, because the major central banks continue to pay attention to inflation and strong needs than goals.However, the Swiss Bank’s unexpected interest rate cut last week, as well as the Pigeon Puppets of the Federal Reserve President Powell, the British Bank of the British and the European Central Bank governor to make investors have reason to have reasons to prepare for the upcoming loose policy again.

For fund managers of Pacific Investment Management Corporation and Berlaide and other institutions, as well as Bill Gross, the former “King of Bonds”, the prospect of interest rate decline has enhanced the attraction of five years or shorter bonds.As the expected expectations of interest rate cutting will rise, investing in such bonds will get the greatest benefits.

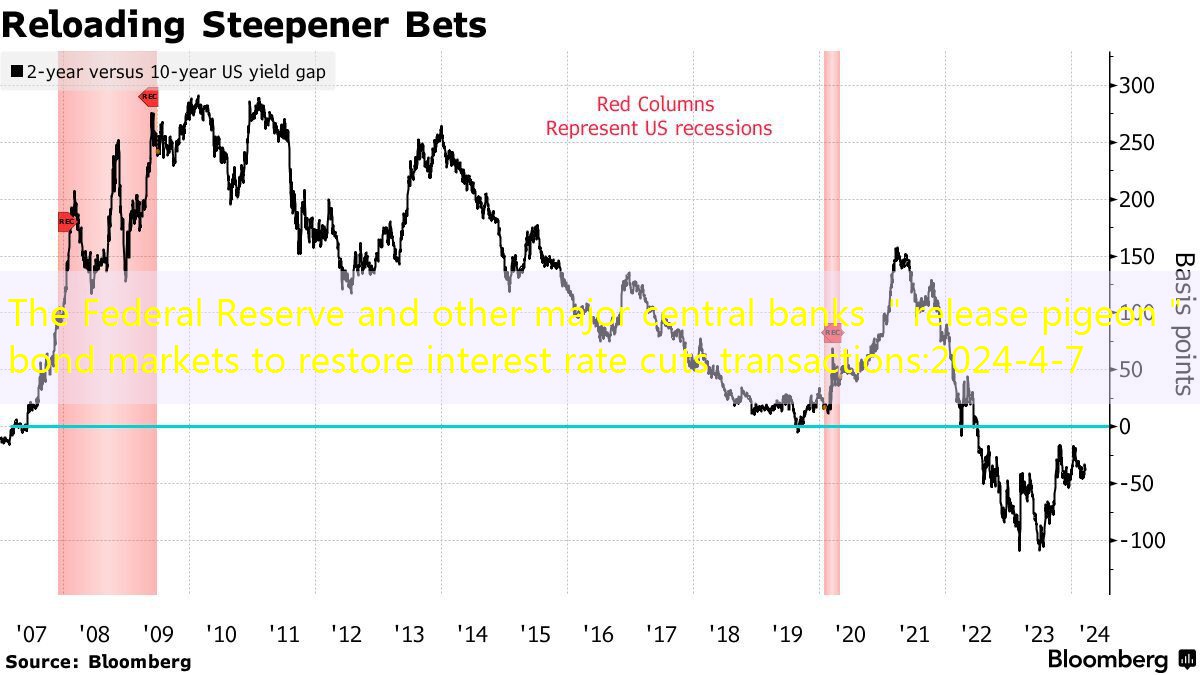

The excellent performance of short -term bonds for long -term bonds is the reason why the so -called yield curve becomes steep.Of course, given that inflation is still high and the labor market continues to be strong, the central bank may still be unable to prove that the bullish prospect of short -term bonds is correct.

JIM Reid, the director of the global economy and theme research of Deutsche Bank, said: “Whether we really get the price reflected in the price is yet to be discussed. But as far as the current development direction is concerned, the prospects are the most important.” He added that although the market said, the market said that although the market, the market said that although the market, the market said that although the market, the market said that although the market, the market said that the market said that although the market, the market said that although the market, the market said that although the marketPay attention to the “pigeon narrative”, but it is worth remembering that the view of interest rates has changed around 2024.In fact, Jim Reid and his colleagues believe that in this cycle, the market has turned seven times to the pigeon policy prospects, but the results of the last six times are actually eagle.

At present, investors feel a scene at the end of 2023.At that time, the US Treasury bond market seemed to fall for the third consecutive year, but as the global market generally expected that policy makers will cut interest rates in early 2024, the U.S. Treasury market will rebound before the end of last year.

Although the major central banks seem to be in the same pace, they may still act at different speeds, which may bring opportunities to make money.Michael CUDZIL, the investment group manager of Pacific Investment Management Company, said: “The European Central Bank, the Federal Reserve, and the Bank of the United Kingdom are likely to start rate cuts in the middle of this year. This is similarities.”Different, this is a good thing for a fixed income market. “

Interest rate traders tend to regard June as the beginning of the Federal Reserve’s loose cycle. Earlier, they expected that the Fed’s loose cycle would begin in March.For the full year of 2024, their expected interest rate cuts slightly higher than the 75 basis points expected by Federal Reserve officials.June is also the time when the market expects the European Central Bank and the British Bank of the United Kingdom to start paying interest rates, and the market has digested the expectations of the two central banks at least a few times this year.

“If the major central banks act in their own way, we may see the Federal Reserve, the European Central Bank and the British Bank of the British before the end of the first half of the year.It doesn’t make sense to fight against the central bank. “

Kellie Wood, deputy head of the fixed income in Sydney in Sydney, believes that most major central banks’ pigeon positions “make the bond market one of the best markets this year.”However, she believes that there is room for differences, especially when the US presidential election is about to be held in November.

Kellie Wood said: “The Federal Reserve is very likely to cut interest rates 50 basis points before the November election, but we think this is the best window.” Her investment portfolio maintains neutrality on short -term US short -term bonds, and in Europe short -termBonds and British Phnom Penh bonds choose to do more.

It is worth mentioning that although the US bond yield curve became steep after the Fed announced last week, the yield of the 2 -year US debt is still about 40 basis points higher than the 10 -year US debt yield, from 2022, from 2022Since the middle of the year, the 2/10 annual yield curve has been upside down.