Recently, the news that “Decathlon quietly increased the price” suddenly circulated on the Internet, causing great attention from netizens.Decathlon has always been loved by consumers with affordable prices, and the topic of its product price increases immediately occupied the first position of hot search.The reporter of the upstream NewsIn addition, the reporter found that many outdoor sports brands are quietly rising.

Decathlon is quietly raising the price

As a parental brand from France, Decathlon has always been loved by “cost -effectiveness”.When the founder Michelle Leelec founded Decathlon, his original intention was to build a cheap but diverse sports retail brand, which is why Decathlon’s English name was taken from the ten vertical meaning.The biggest advantage of Decathlon is the relatively low price, and the product category is very rich: in a Decathlon store, consumers can find almost all categories of sports equipment, as large as camping tents, skilets, small sunscreen spray, shake cups, etc.wait.

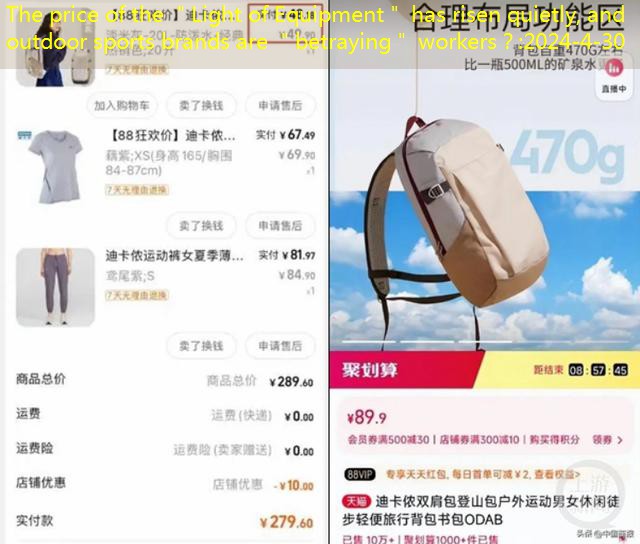

In people’s minds, Decathlon acts as the role of “cheap supermarket” in the sports field.Compared with the big names such as Nike and Adidas, Decathlon’s price advantage is very obvious, and a large number of customers patronize Decathlon’s stores because of cost -effectiveness.However, many domestic netizens have recently discovered that Decathlon has quietly increased prices.Some netizens revealed that the price of Decathlon white cotton short sleeves rose from 19.9 yuan to 39.9 yuan. A 20L backpack increased from 49.9 yuan to 89.9 yuan. A 199.9 yuan charge increased in August 2023 to 249.9 yuanEven many consumers have compared their previous orders screenshots with their current prices.

An old Decathlon user who loves outdoor told the media that Decathlon’s price increase trend is getting more and more obvious, especially after the outdoor sports in the past two years.In February 2022, the prices of two outdoor climbing shoes she purchased were 299 yuan and 349 yuan (real paid 257 yuan, 279 yuan).Today, the prices of the same products on stores and official website have risen to 399 yuan and 499 yuan, and there are no discounts in the store.

“Two years ago, I spent nearly 49 yuan to buy a Decathlon backpack, and now the price has risen to almost 90 yuan.” On the Xiaohong Book platform, Ms. Fu, Consumer Fu, also shared the screenshot of the backpack she bought.

The reporter noticed that in addition to the backpack, Decathlon’s down jackets, jackets, and shredded velvet jackets also increased prices.Some consumers have found that the price of a Dazhakon jacket was 150 yuan before, the supporting pilling jacket was 100 yuan, and the same puncture jacket was now 235 yuan after discounts, 130 yuan for shake pills, and the price of the set rose exceeded 100 yuan.Essence

In addition, Decathlon price increases have long been “threatened”.It is reported that in 2021, about 1/10 of Decathlon’s about 1/10 of the commodity prices in Taiwan, about 26%.Decathlon responded that the price increase was affected by raw materials and transportation costs.

Replace the logo towards the high -end market

It is worth noting that at the same time, Decathlon has just completed a brand upgrade.On March 12 this year, Decathlon issued a new logo.In the process of Decathlon’s 48 -year brand development, this is the fourth update brand logo, less than three years before the last time the brand image was replaced.

The update of brand logo also means the adjustment of brand strategy.”Our strategy is to create a professional sports brand in multi -field.”

From sporting goods retailers to professional sports brands, Decathlon has brought a new strategic “Arctic Star”: the products of different brands of products are attributed to nine major sports categories such as outdoor sports, water sports, and mountain riding sports., Four major brands of rock climbing and hunting, including some high -end brands with high pricing.In addition, Decathlon also cooperated with the 2024 Paris Olympic Games and the Paralympic Games, hoping to help Decathlon’s development to the high -end market.

Decathlon’s high -end transformation intention is also reflected in personnel changes.In 2022, Decathlon found professional manager Barbara Martin Coppola to serve as Decathlon’s first CEO.Before joining Decathlon, the female executives who have been responsible for digital business at the iKEA, Google, YouTube, Samsung and other companies are good at marketing and leading business transformation.Earlier this year, Decathlon dug Zhang Xiaoyan, the head of the Chinese brand in Lululemon, and served as CMO in China.As the pioneer of Lululemon in the Chinese market, Zhang Xiaoyan successfully established brand viscosity through accurate positioning consumer groups and community operation models during the eight years of term.

Why does Decathlon “turn” high -end?Perhaps it is evident from its financial figures.

In 2022, Decathlon’s sales reached 15.4 billion euros (about 111.77 billion yuan). This number seemed very considerable, globally, this result was second only to the two giants Nike and Adidas.However, in terms of performance growth, Decathlon’s sales increased from 21.3%in 2021 to 12%in 2022.In addition, in 2022, Decathlon’s net profit was 923 million euros (about 7.218 billion yuan), the net interest rate was 5.9%, and its profitability was far lower than Nike and Adidas.Nike’s net profit margin in fiscal 2022 was 11.8%; although Adidas lost money in the fiscal year, the net interest rate in previous years was generally higher than 10%.

Obviously, when the road to Sub -profit is about to come to the end, Decathlon hopes to seize more outdoor economic dividends by introducing new executives and streamlined business lines, and strive to share a share on the “high -end table”.

Outdoor brands are rising as a whole

In fact, in addition to Decathlon, looking at the entire outdoor sports industry, the price increase is almost the overall trend of the market.

According to magic mirror data, in the past year, the prices of 4 types of sports clothing such as POLO shirts, sports pants, skin clothes, and running clothes on Tmall have risen to varying degrees.

At the same time, the price increase of major sports outdoor brands is also continuing.According to Tmall’s sales data, only domestic and foreign brands, including the north, the north, the north, the males, Colombia, camels, underniaers, and roadkeepers.Among them, domestic brands with relatively cheap prices have a more obvious price increase.

Domestic brand Kaileshi has been taking the cost -effective route before, and has also received praise in the outdoor circle due to cost -effectiveness, but now its price has been close to the north.Netizens said that the brand’s wind hunting series was priced at 5600 yuan in 2022, and it had risen to 1,000 yuan in 2023.In addition, the price of a tent is also as high as 5,000 yuan, and the price is close to many outdoor big names.

Uniqlo, which has always been cost -effective, also rose price increases.In November last year, an article “20,000 monthly salary, unable to afford Uniqlo” burst into fire on the Internet. Some consumers voiced: “The previous 49.9 yuan style, now it is basically 79.9 yuan or 99.9 yuan to buy.”In April of this year, Sanlian Life Weekly also questioned the “more and more expensive Uniqlo, was abandoned by Chinese consumers” and questioned the price increase of Uniqlo related products.

On the 17th, upstream journalists consult the customer service of Uniqlo Tmall’s official flagship store by phone.A staff member said: “The goods sold online are the price of the goods from the factory, and the price may be done in the future. As for the price increase, there is no relevant notice for the time being.”In the “price change” column, there are the following tips: “Based on the actual business status, the price of goods sold through the official sales channels of Uniqlo may be inconsistent.The price of your purchase of goods should be based on the actual purchase price of the product when purchasing the product in the relevant Uniqlo. “

At the beginning of this year, the well -known outdoor sports brand’s apparent bird also announced that it will increase the retail price of brand product products throughout the board from February 15th, including brand direct -operated stores and online malls. The average increase in products across the board is about 20%to 30%.The relevant person in charge of the Ariter Bird explained that the price raising this time was mainly due to the high cost of production and logistics.

In the second -hand market, the original bird’s “Dragon Limited” charge is also a strange goods. The original price of the original price of 8,200 yuan has been fired to about 16,000 yuan, and the price has further increased.

Domestic market demand stimulate brand upgrade

At present, the outdoor sports industry is ushered in unprecedented development opportunities, and the competition of outdoor sports brands is quietly hot.In October 2023, the opening ceremony of the 2023 China Outdoor Sports Industry Conference and Summit Forum were held in Dali, Yunnan. The forum released the “China Outdoor Sports Industry Development Report (2022-2023” (hereinafter referred to as the “Report”). From January to October 2022, there were more than 30,000 newly registered enterprises in my country. The “my country Outdoor Sports Camp Real Estate Development Report 2023” jointly compiled by the Tourism Research Institute and Zhongtong Industry Group released.

The Chinese consumer market is currently facing a gradual differentiation. While high -end consumption and price rise, Volkswagen consumption is becoming more and more needed.Analysts pointed out that the high -end is inevitable in the Chinese market: when the entry player grows into an advanced user, it may abandon Decathlon to a higher -end brand, which is particularly obvious in the Chinese market with polarization of polarization.Decathlon needs its own high -end brands to absorb these potential “losses”.But while Decathlon develops high -end products, it is also reluctant to completely abandon cost -effective products.Judging from the official statement, Decathlon has no intention of comprehensive and high -end.Recently, Fabien Brosse, the chief product brand officer of Decathlon, said in an interview: “Being a high -end brand is not an easy task. Low -threshold sports are still the core business philosophy of Decathlon, but the two can be parallel.”

In the past, Decathlon focused on cost -effectiveness, and now he hopes that cost -effectiveness and high -end have both.For a brand, if you want to impress the mass consumer market at a cost -effective performance, it also has the ability to capture the needs of high net worth individuals, which is obviously difficult to be small.For the public, if the brand’s premium exceeds psychological expectations and seeks more cost -effective alternatives, it seems to be a more rational choice.

Upstream journalist Yang Bo Jinxin part of the content according to the China Business Daily and Surging News

Report/feedback